Sale!

Event Timing: এখনো নির্ধারিত নয়, ( স্টুডেন্ট হওয়া সাপেক্ষে ডেট ফিক্সড করা হয়ে)

Event Timing: এখনো নির্ধারিত নয়, ( স্টুডেন্ট হওয়া সাপেক্ষে ডেট ফিক্সড করা হয়ে)

প্লাটফর্ম- জুম

প্লাটফর্ম- জুম

১ম দিন দুইটা সেশন (সন্ধ্যা ৭টা থেকে রাত ১১টা পর্যন্ত)

১ম দিন দুইটা সেশন (সন্ধ্যা ৭টা থেকে রাত ১১টা পর্যন্ত)

২য়, ৩য়, ৪র্থ, ৫ম ও ৬ষ্ট একটা করে সেশন, ( সন্ধ্যা ৮টা থেকে রাত

২য়, ৩য়, ৪র্থ, ৫ম ও ৬ষ্ট একটা করে সেশন, ( সন্ধ্যা ৮টা থেকে রাত  ১০টা পর্যন্ত)

১০টা পর্যন্ত)

৭ম দিন মানে লাস্ট ডে দুইটা সেশন।(একটি অতিরিক্ত সেশন) ( সন্ধ্যা ৭টা থেকে রাত ১১টা পর্যন্ত)

৭ম দিন মানে লাস্ট ডে দুইটা সেশন।(একটি অতিরিক্ত সেশন) ( সন্ধ্যা ৭টা থেকে রাত ১১টা পর্যন্ত)

ট্রেনিং শেষে সার্টিফিকেট দেওয়া হবে।

ট্রেনিং শেষে সার্টিফিকেট দেওয়া হবে।

ট্রেনিং শেষে বেসিক ট্রেনিং পার্টিসিপেন্টদের নিয়ে তৈরি করা গ্রুপ BTA তে এক্সেস দেওয়া হবে। যেখানে ট্রেনিং পরবর্তী সময়ে ট্রেইনারদের সাথে যোগাযোগ করতে পারবেন ও শিক্ষামূলক যেকোন জিজ্ঞাসা করতে পারবেন।

ট্রেনিং শেষে বেসিক ট্রেনিং পার্টিসিপেন্টদের নিয়ে তৈরি করা গ্রুপ BTA তে এক্সেস দেওয়া হবে। যেখানে ট্রেনিং পরবর্তী সময়ে ট্রেইনারদের সাথে যোগাযোগ করতে পারবেন ও শিক্ষামূলক যেকোন জিজ্ঞাসা করতে পারবেন।

Training

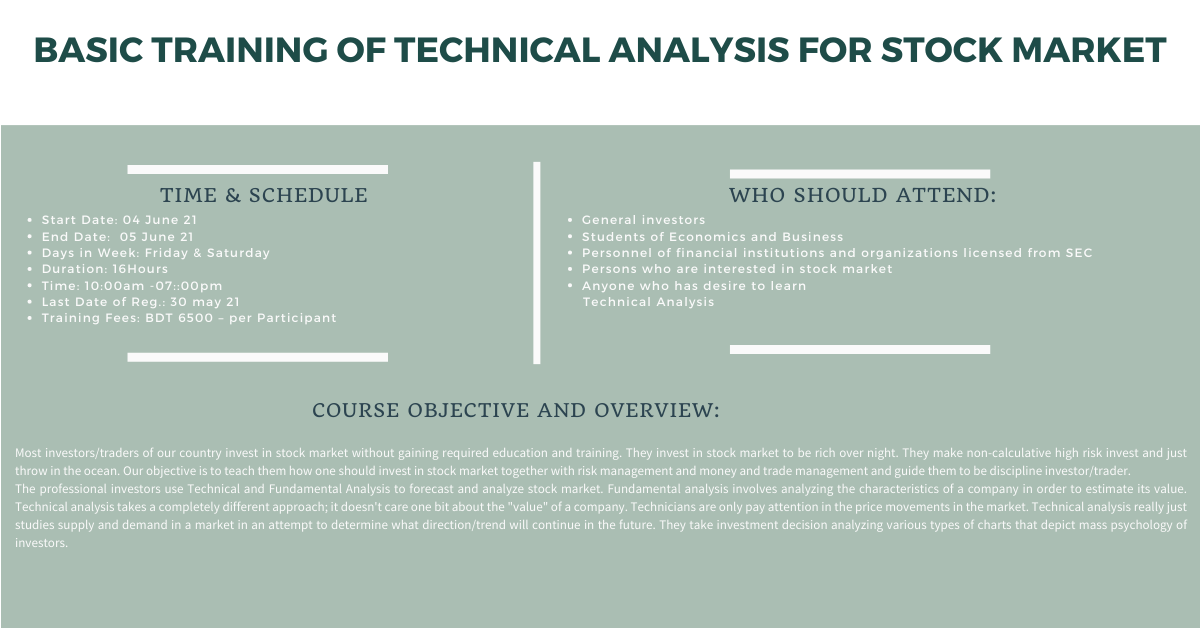

Basic Training Of Technical Analysis For Stock market (Online)

Original price was: ৳ 8,500.৳ 5,000Current price is: ৳ 5,000.

Basic Training Of Technical Analysis for share market

Event Timing: এখনো নির্ধারিত নয়, ( স্টুডেন্ট হওয়া সাপেক্ষে ডেট ফিক্সড করা হয়ে)

Basic Training Of Technical Analysis for share market

১৬ ঘন্টার ট্রেনিং, সেশন ৮টি, প্রতি সেশন ২ঘন্টা করে।

ট্রেইনার সংখ্যা ৩জন।

ট্রেইনার নাম-

- মাহমুদুল আলম (হেড অফ রিসার্চ, ডিসিশন মেকার লিমিটেড)

- রাকিব আহমেদ ( আর এন ডি ডিপার্টমেন্ট, রয়েল ক্যাপিটাল)

- মোহাম্মদ সাইফুল ইসলাম

ট্রেনিং এ আমরা যা যা আনুসাঙ্গিক দেওয়া হবে

- Lecture sheets, Notebook, Pen, file, mask,

- lunch and two tea or coffee per day

- amibroker software, and EOD data from 2007- to last Day.

কারা ট্রেনিং এ জয়েন করতে পারবে?

Anyone who desires:

- to learn technical analysis and

- would like be a profitable trader/investor.

Sessions Outline and Topic Covered

Session – 1: Introduction and Understanding of Stock Market

-

Stock market and stock exchanges

-

Regulator – objectives and functions

-

Related terms and words

-

Instruments – share, bond and mutual fund

-

Primary, secondary and OTC market

-

Types of investors

-

NAV, EPS, PE, dividend and dividend yield

-

DSE company page information

Session – 2: Candlestick Charts – Part one

-

Introduction to various types of charts

-

History of candlestick chart and its benefits over others

-

Formation of a standard candle with live example

-

Descriptions of some single and double candlesticks charts

-

Trade entry, exit and stand aside criteria

-

Examples analysis and discussion

-

Participants findings of different candlesticks on stock charts

Session – 3: Candlestick Charts – Part Two

-

Descriptions of some multi candlesticks charts

-

Trade entry, exit and stand aside criteria

-

Examples analysis and discussion

-

Participants findings of different candlesticks on stock charts

-

Support and resistance with candlesticks

-

Trade results mindset

Session – 4: Amibroker installation and use of Indicators and Oscillators

-

Advantages and disadvantages of Amibroker

-

Installation and database formation

-

Data feed

-

Amibroker customizations

-

Types of moving averages and their use

-

Guppy Multiple Moving Averages

-

Identification of trend

-

Support and resistance detail analysis

Session – 5: Profitable use of Indicators and Oscillators including Divergences

-

What is RSI, MACD and their calculation

-

Overbought and oversold zone and confirmation of reverse

-

On balance volume and Accumulation and distribution line

-

Bullish and bearish divergence identification

-

Money flow index

-

Ichimoku

-

Other indicators and osccilators

-

Entry and exit planning

Session – 6: Important Chart Patterns like Triangles, Head and Shoulders etc

-

Famous profitable chart patterns

-

Their characteristics

-

Identification

-

Entry, exit and stand aside criteria

-

Examples discussion

Session – 7: Elliot Wave Principles (EWP) and Stand aside Position

-

Introduction, benefits and drawbacks of EWP

-

Motive waves and corrective waves and combination

-

Rules of EWP

-

Major patterns

-

Fibonacci ratios and wave proportionate

-

Wave and pattern identification and discussion

Session – 8: Trading Psychology, Entry and Exit Strate

-

Bull and bear market

-

Institution and smart money

-

Behavioral finance and biases

-

Market cycle – bear to bull to bubble to crash

-

How to use stop loss

-

DSE Mobile App usages

** Please note that every session will include a segment for question and answer. The above topics are indicative but not limited to.

Reviews

There are no reviews yet.